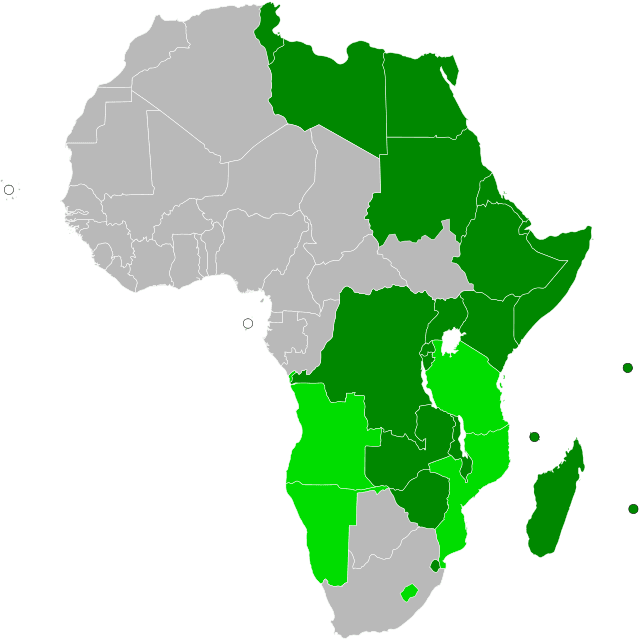

The Common Market for Eastern and Southern Africa (Comesa) has officially launched its first interoperable cross-border digital payment system, connecting Malawi and Zambia in a milestone for regional financial integration.

The system, known as the Digital Retail Payments Platform (DRPP), allows individuals and businesses in both countries to make instant, low-cost transactions directly in their local currencies, eliminating the need for U.S. dollars or other hard currencies in routine trade.

Supervised by the Reserve Bank of Malawi (RBM) and the Bank of Zambia (BoZ), the platform is a major step towards Africa’s broader goal of achieving a seamless and inclusive regional digital economy.

Comesa’s Chief Operating Officer Jonathan Pinifolo noted that the system links both banks and fintech players, including mobile-money operators such as TNM Mpamba, FDH Bank, and Finca Malawi.

“This innovation removes the dependency on hard-currency settlements and empowers African traders to operate securely and efficiently,” Pinifolo said.

For small-scale traders in border regions such as Mchinji, the rollout means quicker settlements and reduced risks linked to carrying physical cash across frontiers.

Comesa Secretary-General Chileshe Mpundu Kapwepwe described the initiative as a “turning point for intra-African trade,” emphasizing its value for women traders who can now “travel safely without carrying cash.”

Comesa Chairperson and Kenyan President William Ruto praised the pilot, urging member states to invest further in digital infrastructure and interoperable systems to strengthen trade across the continent.

He also called for the adoption of electronic certificates of origin and single-window systems to streamline cross-border commerce.

The launch comes amid a surge in digital finance adoption across Africa. According to the World Bank’s Global Findex 2025 Report, over 61% of adults in developing economies now use digital payments, with Sub-Saharan Africa leading global growth.

In Malawi, where mobile-money penetration remains below 45%, the DRPP could reduce dependence on foreign currencies, preserve foreign reserves, and strengthen the kwacha’s role in regional trade.

Experts view the move as a practical step toward the African Continental Free Trade Area (AfCFTA) vision, which aims to make African trade faster, safer, and more self-reliant.